Achieving financial freedom is a goal that many strive for but few truly understand how to attain. Whether you’re just starting your financial journey or looking to refine your strategies, these ten essential steps will help guide you toward financial independence. In this comprehensive guide, we’ll cover practical tips and actionable advice to help you take control of your finances, build wealth, and secure your financial future.

1. Create a Budget and Stick to It

A budget is the cornerstone of any financial plan. Start by tracking your income and expenses to understand where your money is going. Use budgeting tools or apps like Mint or YNAB to help you manage your finances. Allocate funds to essential expenses first, then prioritize savings and investments.

2. Build an Emergency Fund

An emergency fund acts as a financial safety net. Aim to save three to six months’ worth of living expenses in a readily accessible account. This fund will help you cover unexpected expenses, such as medical bills or car repairs, without derailing your financial plan.

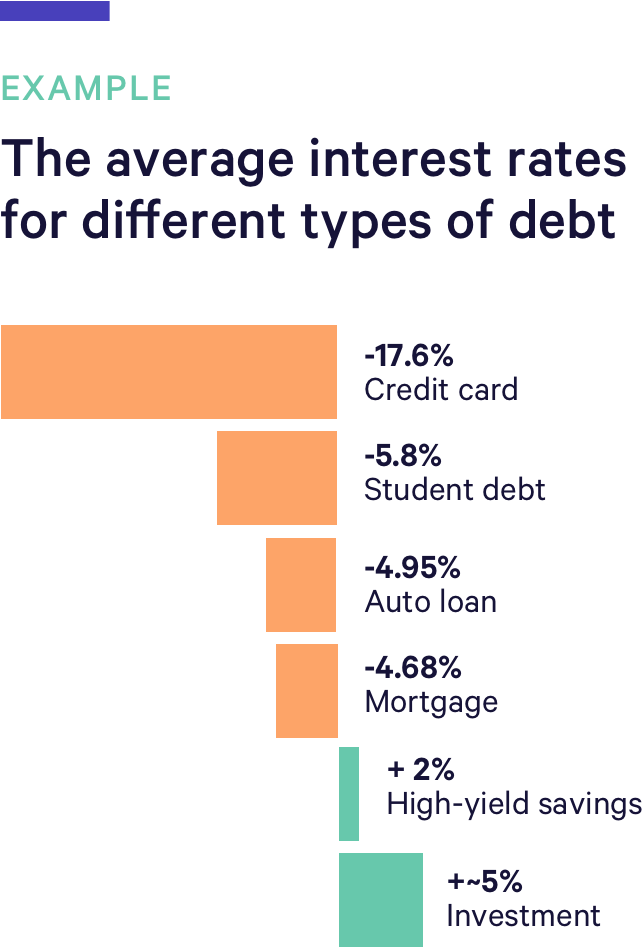

3. Pay Off High-Interest Debt

High-interest debt, such as credit card balances, can quickly become a financial burden. Focus on paying off these debts as quickly as possible. Consider using the debt avalanche method, which prioritizes debts with the highest interest rates, or the debt snowball method, which starts with the smallest balances.

4. Save for Retirement

It’s never too early to start saving for retirement. Contribute to retirement accounts such as a 401(k) or IRA. Take advantage of employer matches if available, and consider increasing your contributions over time. The power of compound interest means that the earlier you start, the more your money can grow.

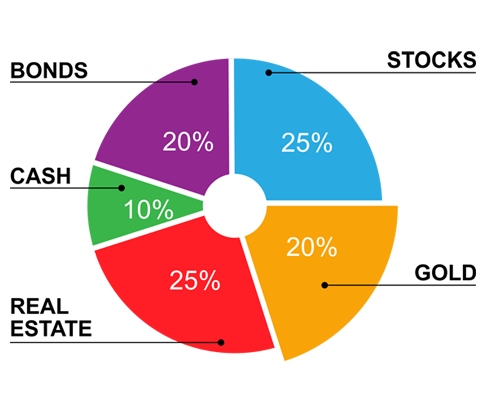

5. Diversify Your Investments

Diversification is key to reducing risk and maximizing returns. Spread your investments across different asset classes, such as stocks, bonds, and real estate. Consider low-cost index funds or exchange-traded funds (ETFs) for a balanced portfolio.

6. Increase Your Income

Look for ways to boost your income, whether through a side hustle, part-time job, or passive income streams. Consider leveraging your skills to offer freelance services or starting a small business. Increasing your income can accelerate your journey to financial freedom.

7. Live Below Your Means

Adopting a frugal lifestyle can significantly impact your financial health. Focus on spending money on things that truly matter and cut back on unnecessary expenses. Living below your means allows you to save and invest more of your income.

8. Educate Yourself About Personal Finance

Knowledge is power. Continuously educate yourself about personal finance through books, podcasts, blogs, and courses. Understanding financial concepts and strategies will empower you to make informed decisions and avoid common pitfalls.

9. Set Financial Goals

Define clear, achievable financial goals for the short, medium, and long term. Whether it’s saving for a down payment on a house, building a college fund, or planning for early retirement, having specific goals will keep you motivated and focused.

10. Review and Adjust Your Plan Regularly

Financial planning is not a one-time task. Regularly review your budget, investments, and goals to ensure you’re on track. Adjust your plan as needed based on changes in your income, expenses, or financial priorities.

Achieving financial freedom requires discipline, knowledge, and a well-thought-out plan. By following these ten essential steps, you can take control of your financial future and work towards a life of financial independence and security. Start today, and remember that every small step counts towards your larger financial goals.